I made 12bn profits in April 2025 from which i distributed nothing this month. Therefore, my wealth rose by 12bn to 2.254 trillion isk.

That said, i did take writedowns of around 36bn (more below) so underlying was 48bn isk profits. But writedowns today are merely profits i recognised in prior months that i should not have - so i can't ignore them.

Overall then a poor month. Holidays and real life getting in the way. And writedowns.

Hopefully May will be better.

Distributions

These days, the aim is to distribute my profits to the Oz Tank Show or other ventures.

In April i distributed nothing 50bn to the The Oz Show or any other ventures.

So far i have given 388bn to Eve shows:

The Oz Tank Show started in July 2023 and i have generated profits of 1.389 trillion in the July 2023 - April 2025 period and distributed 388bn.

So that leaves 1 trillion isk to distribute to some venture(s).

It is early days but the Oz Show is considering having some of its tycoons sponsor a new Corporation. Lets see.

Six Omega Accounts to pay for / Skill Farming

In June 2024 i went for the MCT / Omega deal and have now pre-funded 6 accounts (so the 4 omega accounts and 2 alpha accounts) for 12 months.

This also took me into Skill Farming for the first time.

I spent 130bn isk on all that. The way i accounted for this was to say that the 130bn isk was an asset spent to buy Omega and as i made profits from skill farming i would reduce this asset.

In other words, skill farming would not contribute to increasing my wealth until i had made 130bn isk profits.

I achieved that goal in January and therefore all skill farming profits i now make is profit towards increasing my wealth.

The basic numbers for April

In April i had sales of 301bn isk vs March of 317bn. So a decline of 5% and below my long term average of £325bn. This reflects me being on holiday and real life being busy.

This comes to average daily sales of 10.0bn isk. In other words, each evening i expect to see across all my accounts an additional 10bn isk (less transaction taxes) sitting on the characters to be reinvested back into the markets.

Item profits were 87bn isk which is a margin of 29% (87/301). So above the 25% target and as ever a pleasing result. There will be an upwards distortion from Skill Farming in here which i am sure i could work out if i had the time.

Taxes and Courier fees came to 38bn isk. That takes the Trading Profits to 49bn isk and so a trading margin of 26.2% (49/301). So a rare occurrence where i am right at the 16% margin target.

I then had a series of other costs.

16bn of writedowns: my rule is to reduce sell orders to make them the most competitive all the time but occasionally i leave them and i get a stack of old Sell Orders way off the competitive price and so i make the decision at times to write them down to the most competitive price all at once. Takes a burden off my shoulders and causes an accounting loss. In this case of 16bn isk.

20bn which i can't recall. For the life of me i don't recall what this cost was for. A misposting perhaps.

That took me to 12bn profits for April.

What is needed to get wealth to rise to 100bn in a month?

In some ways, i am there now - lets see if i can get this to work.

I would need to make daily sales of 18bn on my 25% item market - that has never happened. Therefore, to achieve 100bn profits a month i need to do one or some of three things.

1) Increase my item margin above 25% - possible but a risk.

2) Keep on doing Skill Farming - for the next 3 months i will be earning pure profits from Skill Farming, so this will be done.

3) Expand into station trading - i sort of do that but not to any big deal. So this is possible.

My Sales Strategy

I am putting more effort into designing spreadsheets using the Eve Excel Addin to both make my online time more efficient and find those items to sell in the Regions quicker.

This is allowing me to move faster each night. Currently, i can now see which of my trades need updated and go straight to them rather than cycle through all trades. I can also see which sales have been made so i can see if i can replace them. I can also see what items i can buy from Jita Sell Orders to put up for sale in the trade hubs and make my target margin.

My strategy is to Buy from Sell Orders in Jita to sell in the trading hubs in other Regions.

I don't sell consumable items such as ammunition given they tend to be high volume and very competitive. That includes ships.

I rarely sell items used as components in manufacturing because the end buyer tends to be cost conscious (and armed with spreadsheets) and able to manufacture the items themselves if market prices are too high.

I sell items that are in low supply and sell very slowly. These items tend to have very low competition - sellers want to get cash quickly and so don't bother in these items. If i put an item on the market and it sells in 15 days that is fine with me.

These items also tend to be price insensitive - players will buy the item almost whatever the price. The Buyer is much more interested in getting the item to use now rather than setting off to Jita to get it cheaper.

I sell items that are typically bought to kit a ship as a player progresses or has to replace a destroyed ship / pod.

Each month i sell 20-30% of what i had to sell at the start of the month.

I have a rule that the minimum profits have to be 100m isk. It is no use me buying items for 5m to sell them for 15m. The profitability may be great but that won't move the dials. That said, it is surprising how many items i can buy for 120m from Jita Sell Orders and sell for 220m in the other trading hubs. At that isk level, players re-equipping don't care about spending an additional 100m isk to save time.

And in the secondary trading hubs Amarr / Dodixie / Rens / Hek buyers will not travel even one jump to buy a cheaper item. For example, i can post an item for sale in the main Rens Trading up for 300m, and even if one jump away the same item is for sale for 250m the item in the main Trading Hub will still be the item sold.

Therefore, i mostly sell Implants, Blueprints, ship equipment and some structure modules. And more recently Large Skill Injectors.

What is selling well in April

Quite a scrabbly month where i struggled to get any sense of consistency or theme going.

I am seeing more competition in Dodixie and Amarr, notably in ship equipment and blueprints.

Blueprints: these have slowed down now - not because of the additional competition though, the market feels genuinely slow here.

Implants: these have also slowed down which in part reflects that i am focusing on higher priced inplants.

Ship Equipment: remains a decent income generator.

Mining equipment: almost nothing sold other than a few high priced items. The competition is all over this and the margins are too low.

Manufacturing

I am now making a fist of moving into this.

Early days, i am making some profits and will update this blog as i go.

Ideally, i want to create a process that i can scale.

Planetary Interaction

For now, i have stopped trying to make this work.

Research

For now, i have stopped trying to make this work.

Station Trading

All in Jita. And i am not focusing on this for now, so only 25bn sales.

I don't really have a process up and running that is scalable.

My idea of station trading is not buying items when they look cheap. For me, station trading is about sticking to the slow moving items and quite often i am the only person in Jita trying to sell an item. Almost always Selling for over 1bn isk.

What i don't do is Investing. I.e. i don't buy an item now i think is cheap and hold onto it to sell it a few months later when the price has risen.

Alpha Accounts

I have 1 Alpha account with a character in Venal left. All the others were upgraded to Omega last summer to start Skill Farming.

I also added another character to that account and am training it up to 5m skill points. The idea here is to get another set of Alpha Accounts ready for Skill Farming sometime in the future if needed.

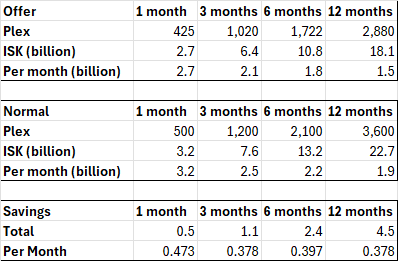

Plex

At the start of September i bought 8000 Plex at around 5.3m each. The main reason for doing this is to have a store of plex ready in case of any deals on the NEX store that comes along. I now have 18,300 Plex.

Items in hanger for sale

There are a number of items that i sell that can only be sourced from Regions outside of The Forge (the home of Jita).

To make my life easier, i buy them from their home bases and have them couriered to Jita to be stored ready to be couriered to their final sale destination.

In all, some 421bn isk of items.

Buy Orders

Buy Orders have varied over time and peaked at around and are at a new high of 101bn. Whilst i am not focusing on Station Trading in Jita i am taking more opportunities in all this,

Once i get a grip, Buy Orders will also increase as i ramp up the Station Trading in Jita.

ISK

I have 134bn spare ISK kicking around.

For the last 12 months the average ISK in wallets has been over 100bn compared to around 50bn before this.

The reason for his is purely real life being busy and so not having the time to make sure everything is invested.

It feels a waste - i should have as much as i can invested. I have Plex ready for any NES deals that come along.

If i think about this: Inventory + ISK = 421 + 134 = 555 = 25% of my wealth is sitting around not earning a return!

Current Wealth

Current wealth is 2.254 trillion ISK made up from:

- Plex held as an investment 117bn ISK

- Items in hanger for sale 421bn ISK

- Items in hanger for use in business 11bn ISK

- Omega brought forward 0bn ISK

- Buy orders on the market 101bn ISK

- items for sale 1.84 trillion ISK

- less a 20% provision 367bn ISK*

When i add up my wealth, I don't count assets I use in the course of my business such as ships, fittings etc nor do I add back any expenses such as skills purchased etc. The wealth I disclose is made up of items that are ISK or are in the process of being converted to ISK or are used to generate isk that can be readily resold back onto the market. Any ships or skills or fittings etc i buy are counted as expenses in that month. The only exception to this rule is Blueprint Originals i use for manufacturing. They are held at cost.

* I take a 20% provision against the items I am selling. Eve calculates wealth by adding up the value of the sell orders hence it is possible to increase your wealth by buying an item for 100m ISK and putting a sell order for 120m ISK (in this case your wealth would increase by 20m ISK). For me, I want my wealth to be calculated at cost. I know that the value of my sell orders will likely fall over time as I update my orders downwards as competition reduces their prices before my items are sold. Hence the 20% provision is my best guess as to what the maximum reduction I would need to make to my sell orders as a whole before they are sold. In an ideal world I would value my sell orders at the value which I bought the items for.