Pearl Abyss has released its Q3 results (July - September 2023). The webcast and link to their presentation is on their website.

Overall

Revenues were down 12.7% Q3 2023 vs Q3 2022 and up 8.3% vs Q2 2022.

A small operating profit was made though this is still down 82.5% vs Q3 2022, and at the bottom line the net profit was still down 29.6% vs Q3 2022.

Focus on the Revenues and Operating Profits - they tell the story. The Net Profits has all sorts of things going on that don't really relate to gaming.

The big news was the delay to the launch of Crimson Harvest. It had been expected to launch in mid 2024, that has been pushed back to 2025. This has surprised many people - Pearl Abyss was talking about the 2024 launch as recently as August at Gamescom. Also, this follows on from prior delays to the game launch - so worries setting in that there is a problem.

This has pushed back other games as their developers focus on Crimson Harvest. So DokeV now pushed back to 2026.

In all 2024 revenue hopes will likely need to be almost halved from where anyone thought they would be been before this update.

The net effect of this is that Pearl Abyss profits remain reliant on Black Desert and Eve Online and so profits will be very small, at best. Black Desert continues to be in decline, so Pearl Abyss could see losses.

The share price fell 8% which makes it flat over a week - so the shares gave back what they had made on some more optimistic hopes from one broker. That said, sentiment has turned negative on the shares.

What did Management say about Eve?

As usual, not much.

No hard numbers other than revenues (see below).

In the narrative they said:

"For EVE Online, we saw a slowdown in revenue in Q3 due to the base effect of the Viridian update we launched in Q2. However, we continue to see the strength of the EVE IP with new updates, and most importantly, the largest EVE Fanfest ever held to celebrate the 20th anniversary of service.

Notably, the event not only announced news about updates in the second half but also new titles in development, including EVE Vanguard and the EVE Galaxy Conquest. It was an opportunity to showcase EVE's new roadmap for the next decade, carrying on a successful legacy of 20 years in service."

"EVE will also be providing various contents to service. Most notably the new expansion pack EVE Havoc is planned to be released soon, which will support more diversified game play compared to the as-is with new story elements to add more fun to the game."

"We are also preparing for the soft launch of EVE Galaxy Quest, which we announced at Fanfest. EVE Galaxy Conquest is a casual mobile version of the EVE IP that combines exploration, diplomacy, and PvP combat. We're checking those metrics after the soft launch, with a global launch plan for sometime in 2024. Also EVE Vanguard, an FPS expansion pack designed to bring EVE from ship scale to human scale, is undergoing preparations to be made available to select users from December.

EVE Vanguard has been designed to create an organic relationship with EVE Online that goes beyond just playing an FPS game. It took the best parts of Dust 412, a different version of FPS of the EVE IP, and fixed the weak spots. And it has been designed to be both an expansion pack of EVE Online and have its own VM. We expect to see energy with EVE Online sales as well as increased sales of the EVE IP in the future."

Focusing on Eve online - the numbers

Literally, this is it:

In Q3 2023 Eve generated 16.0bn Won in revenues vs 20.2bn Won in Q2 2023 and 19.4bn Won in Q3 2022.

Focusing on Eve online - some analysis looking at the movement in Omega Accounts

Firstly, right off the bat, what we don't know is how the revenue is split between paid monthly subscriptions and other revenues such as paying for Plex, Injectors, etc.

But lets assume, for a moment, it is mostly subscription and the movement in revenues can be explained by pricing and volumes.

When thinking about is 16.0bn Won good or bad, we have to compare the prior year to get a fair comparison (i.e Q3 2022) because that irons out seasonal issues.

In Q3 2022 Eve generated 19.4bn Won.

We have to remember that in Q2 2022 CCP increased the subscription price by 30%. Lets assume therefore that the Q3 2022 revenues had the full price rise in as does the Q3 2023. Therefore, the difference between Q3 2023 and Q3 2022 will be currency and Omega Account numbers.

Quick check on currencies:

The average rates of Won vs USD, Euros and GBP moved +6%, -2% and -5% respectively between Q3 2022 to Q3 2023. Lets therefore assume the overall currency effect was 0% - makes the maths easier.

Therefore, that implied that Omega Account numbers fell 17-18% between Q3 2022 and Q3 2023. That is sort of what we estimated when we looked at the Q2 2023 numbers three months ago.

That is Omega Account numbers, not player numbers. A player can drop Accounts or downgrade Accounts from Omega to Alpha but still remain a player in the game.

Comparing to pre-pandemic

We also know that gaming companies benefited from the covid lockdowns. So it will be fair to compare Q3 2023 (where everyone is out of lockdown) to Q3 2019 which is the last Q3 before the pandemic.

In Q3 2019 Eve generated 14.6bn Won.

Since then the subscription price has risen 30%.

Quick check on currencies:

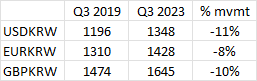

The average rates of USD, Euros and GBP moved -11%, -8% and -10% respectively between Q3 2019 to Q3 2023. Lets call it -10%.

Therefore, in constant currency the revenues from Q3 2019 to Q3 2023 fell 2% (= (16.0/14.6) x (1-10%) -1)

However, between Q3 2019 and Q3 2023 there was a 30% increase in subscription prices and therefore that indicates that Omega Account numbers fell by 24% (= (16.0/14.6) x (1-10%) x (1/(1+30%)) -1)

The complete (translated) Transcript of the webcast is below:

Company Participants

Jin-young Heo, Chief Executive Officer

Seok Woo Cho, Chief Financial Officer

Unidentified Speaker

Other Participants

Jingu Kim

Presentation

Operator

(Foreign Language) Good morning and good evening. First of all, thank you, all, for joining this conference call. And, now, we will begin the conference call of the fiscal year 2023 third quarter earnings results by Pearl Abyss. This conference call will start with a presentation followed by a divisional Q&A session. (Operator Instructions)

Now, we shall commence the presentation on the fiscal year 2023 third quarter earnings results by Pearl Abyss.

Unidentified Speaker

(Foreign Language) Hello. This is Peter Yu[ph] from the Pearl Abyss IR team. First of all, I would like to thank the analysts and investors from Korea and abroad for taking time to take part in the earnings call for fiscal year 2023 Q3 by Pearl Abyss despite your busy schedules.

(Foreign Language) Allow me to provide a few important notices. Today's earnings results have been prepared for the convenience of the investors and may be subject to change depending on the final closing results. Please note that the accuracy or completeness of the financial and operating results set forth in the earnings release is not guaranteed, and we do not undertake any obligation to update the materials, which speak to the date which they were made.

(Foreign Language) With us today, we have CEO, Jin-young Heo; CBO, Gyeong Man Kim; and CFO, Seok Woo Cho. Mr.Seok Woo Cho, our CFO, will first provide a detailed explanation of our results and then proceed with Q&A.

Seok Woo Cho

(Foreign Language) Hello. I'm Seok Woo Cho, CFO of Pearl Abyss. Thank you once again for taking time out of your busy schedules to participate in our company's earnings call.

(Foreign Language) In Q3, we continued to deliver live services for our Black Desert and EVE IPs. The EVE expansion pack and new clips of the Crimson Desert were released, showing ongoing preparations for the future.

First, I'd like to highlight some of our main business activities and highlights for Q3. Black Desert continued to deliver strong financial results, with user metrics improving significantly across all regions globally, mainly driven by the continued popularity and hype created by the Black Desert Festa in July and the update of the Land of the Morning Light. In fact, average monthly active users grew 36% Q-o-Q in Q3, the highest in the last two years.

In Q3, we continued to make efforts to build on the popularity of Black Desert with the Ulu kita Hunting Grounds update, seasonal servers, and a variety of user-friendly patches. The Black Desert console has been performing well, with the highest user metrics in the recent two years following the release of the of the Land of the Morning Light, and the inclusion in the monthly games by PS Plus has resulted in huge popularity, boosting our user metrics.

Black Desert Mobile is carrying out continuous updates to be enjoyed, including updates of the Land of the Morning Light and new classes. In addition, Black Desert also participated in TwitchCon in Paris, where they organized an event for players to experience and enjoy the Land of the Morning content firsthand, and Black Desert Mobile hosted the Global Hideout Ball to announce updates for the second half and strengthened the user community.

For EVE Online, we saw a slowdown in revenue in Q3 due to the base effect of the Viridian update we launched in Q2. However, we continue to see the strength of the EVE IP with new updates, and most importantly, the largest EVE Fanfest ever held to celebrate the 20th anniversary of service.

Notably, the event not only announced news about updates in the second half but also new titles in development, including EVE Vanguard and the EVE Galaxy Conquest. It was an opportunity to showcase EVE's new roadmap for the next decade, carrying on a successful legacy of 20 years in service.

(Foreign Language) For Crimson Desert, we showcased a wide variety of content improvements within the game at Gamescom last August. In addition to the previously released trailer, we also released a clip on some parts that the users can experience with gameplay. After the release of the video, the official trailer reached more than 2 million views in one day, in particular, with many Korean game companies currently strongly focusing on establishing presence in the console market, the market is maturing and we are seeing a lot of interest coming from the partner companies.

(Foreign Language) Next, I will move on to explain our Q3 earnings results. Operating revenue for the quarter was KRW84.9 billion, up 8.3% Q-o-Q. Operating profit and net profit recorded KRW2.1 billion and KRW15 billion each, respectively, to turn positive.

(Foreign Language) Now, allow me to provide some more color on the operating revenue. First, the operating revenue by core IP. For the quarter for our Black Desert IP, we generated KRW68.4 billion in operating revenue of 21.1% Q-o-Q. Operating revenue for the EVE IP stood at KRW16 billion, down 20.8% Q-o-Q. By region, operating revenue breakdown was 27% in Korea, 20% in Asia, and 53% in North America and Europe. And by platform, 81% of our revenue came revenue came from PCs, 13% from mobile, and 6% from consoles.

Next, I will talk about the operating expenses. In Q3, operating expenses decreased by 10.5% Q-o-Q to KRW82.8 billion. Labor costs decreased 18% Q-o-Q to KRW40.7 billion. This decrease was due to the exclusion of the one-off incentive of approximately KRW8 billion from the previous quarter. As of the end of Q3, our headcount stands at 1,293, out of which 744 are in development positions, accounting for 58% of the total.

Commissions decreased 21% Q-o-Q to KRW14.4 billion. Advertising expenses increased 26% Q-o-Q to KRW10.1 billion due to various offline events, such as Black Desert Festa, Gamescom, and the EVE Fanfest.

(Foreign Language) Lastly, I will cover the key highlights for Q4. Black Desert will continue to deliver a wide variety of new contents in Q4. We recently launched the War of the Roses Pre-Seasons, a new type of large-scale PvP content, and plan to add new contents in December. The War of the Roses is a new type of PvP with new combat rules, aiming to give players a new sense of fun rather than a set of patterns of repetitions.

In addition, we plan to improve the accessibility and usability of the game by reflecting recent user feedback to provide better services. The Black Desert console has recently updated three of its most popular Mythical Dream Horses in the online space. We're also planning to release the new class of Awakening Megu as part of our efforts to keep the user retention, which we have seen improvements in Q3.

We will also follow up on various updates on the PC platform to ensure that we continue to build on the good progress we've achieved. On the mobile side, we want to keep things interesting by releasing a wide variety of new contents.

In addition to content updates, we plan to increase our reach to global users through events such as Cafeon and the Adventurer's Oasis. EVE will also be providing various contents to service. Most notably the new expansion pack EVE Havoc is planned to be released soon, which will support more diversified game play compared to the as-is with new story elements to add more fun to the game.

We are also preparing for the soft launch of EVE Galaxy Quest, which we announced at Fanfest. EVE Galaxy Conquest is a casual mobile version of the EVE IP that combines exploration, diplomacy, and PvP combat. We're checking those metrics after the soft launch, with a global launch plan for sometime in 2024. Also EVE Vanguard, an FPS expansion pack designed to bring EVE from ship scale to human scale, is undergoing preparations to be made available to select users from December.

EVE Vanguard has been designed to create an organic relationship with EVE Online that goes beyond just playing an FPS game. It took the best parts of Dust 412, a different version of FPS of the EVE IP, and fixed the weak spots. And it has been designed to be both an expansion pack of EVE Online and have its own VM. We expect to see energy with EVE Online sales as well as increased sales of the EVE IP in the future.

The highly anticipated Crimson Desert is gradually expanding its reach. Following Gamescom, we will be at G-STAR next week to discuss with various partners at our B2B booth to make preparations for a successful service. Being very mindful of the concerns expressed by many, we are prioritizing quality in our development, but we are also making the necessary preparations to not have the timeline extended too much.

(Foreign Language) This year marks the 9th and 20th anniversaries for Black Desert and EVE, respectively, and we are preparing them for the next 20 or 30 years of long-term service. We will continue to strengthen the live service of both games and make thorough preparations for new titles based on the IPs to achieve good results.

In addition, we will also make the utmost effort to develop new IPs, such as Crimson Desert, to build IPs that can last for more than 20 years. We ask for your continuous interest and support moving forward. Thank you.

Unidentified Speaker

(Foreign Language) This concludes our Q3 2023 earnings presentation. We will now proceed with the Q&A.

Questions And Answers

Operator

(Question And Answer)

(Foreign Language) Now, Q&A session will begin. (Operator Instructions)

(Foreign Language) The first question will be provided by Jingu Kim from Kiwoom Securities. Please go ahead with your question.

Q - Jingu Kim

(Foreign Language) Thank you for the opportunity to ask questions. I have two questions in total, and the previous conference call I think there was a commitment that the development for the Crimson Desert will be completed in the second half of this year. I'm curious whether this commitment can be upheld. So if you can provide a more detailed timeline on the release, that would be much appreciated.

And the second question is regarding the marketing strategy for Crimson Desert. In addition to the plans that you have already explained, for example, moving forward, do you have further plans to release additional trailers or video clips for long-term in-game or even different types of -- because cinematic video clips, because it is targeting and appealing, tried to be a AAA game. So if you have any further release plans for such trailers, it would be much appreciated if you could share.

A - Jin-young Heo

(Foreign Language) So I will take that question. So in terms of Crimson Desert development, we're making much efforts to complete the final touches to the game, as we see the top quality and completeness of the game quality is much important. As we are targeting it to be AAA game on console or platform, we are working on to provide a story line to have much relevance and because, as we said, final touches and the level of quality and completeness is very important. So we are making the utmost effort to relive the quality we targeted.

However, in order to provide the quality we have committed to, we do expect that it might take a little longer than we have expected. However, we are trying to not have a significant delay on the timeline. So, as much as we can, we will speed up the development so that we can release it to the users as soon as possible.

So, currently, we are also ongoing in terms of the final discussions and agreements with partner companies in terms of finalizing the contract. So, please understand that we will not be able to share a detailed timeline on the game release as of now. But, as I mentioned before, we will try to stay quite up to speed so that we are not too late to the market, and we will try to speed up the development process to meet the users as soon as possible.

(Foreign Language) In terms of marketing, for the past year, we have been taking various paths in terms of marketing. So we've been meeting with a lot of our partners to show demos and also gather feedback based on such comments, and we have continuously updating our game quality as a result.

(Foreign Language) Since Gamescom in August, I think there was also the rise of a lot of needs that they wanted more detailed gameplay trailers or clips to be available. So we also have high expectations ourselves to achieve good results. So additional trailers or clips for the playthrough, if we are meeting the expectation that we think that will satisfy the players, we will try to release them as soon as possible.

(Foreign Language) During the upcoming G-STAR next week, we will be setting up a B2B booth so that we can demo our game to the partner companies to gather feedback, and we will use that as our cycle to improve the quality of the game even further. As we are in the final stages of the development, we will also be mindful of how we can strengthen our marketing activities as well.

A - Unidentified Speaker

(Foreign Language) That was the answer by our CEO, Jin-Young Heo. (Foreign Language) We'll now take the next question.

Operator

(Foreign Language) Currently, there are no participants with questions. (Operator Instructions)

A - Unidentified Speaker

(Foreign Language) Currently, I don't think there are any more participants with questions.

So with that, then we will conclude our Q3 2023 earnings call. Thank you very much for joining us today.

I know just about everyone didn't believe Pearl Abyss when it said most of the year that CD would launch in the second half of 2023. I'm just wondering who's reporting on a push back of the date to 2025.

ReplyDeleteso far, only in Broker reports (reports by Investment Banks, for their equity investor clients, on companies they follow). They had been expecting the launch in Q2 2024 but now pushing that out to Q2 2025. I don't see any of this reporting in the main stream media. Always a good chance that the Brokers are kitchen sinking it and perhaps the launch in Q4 2024.

Delete