The CCP Report & Accounts for the year to December

2022 came out today on 2 May 2023.

I suspect I will have a lot more to say in later posts but

quickly going through it yields the below review.

A little bit of background as to what we are looking

at and why

Now, we have to be careful here. There are several parts to CCP mainly in

Iceland but also in the UK, China and US.

Therefore, to get a combined view of all this, and a bit

more, we need to look at the Pearl Abyss Iceland 2022 Report & Accounts

which came out at the same time.

Pearl Abyss Iceland was the company set up by Pearl Abyss in Iceland to buy CCP back in 2019.

Therefore, this post focuses on the Pearl Abyss Iceland

2022 Report & Accounts.

You can access the Pearl Abyss Iceland 2022 Report &

Accounts here and also I have a page on this blog that hosts all the Pearl Abyss Iceland from 2019 / CCP from 2013 to 2018 here. They can also all be found and downloaded

for free from the Iceland Company Register.

Summary

- Game revenues (EVE Online, Echoes and anything else from CCP)

fell 12% from $63.8m to $56.1m

- The underlying loss rose from $8.0m to $19.0m

- The overall loss rose from $8.0m to $70.1m (there was a

$51m impairment I discuss)

- $12.5m cash likely came in through the sale of a “token

warrant”, i.e. crypto currency

- Therefore, after a few new shares being issued the business

did not lose any cash during the year!

- The impact of the Ukraine war and the ending of sales to Russia

is around $800k.

- There is a good chance we can see the salary of the CEO

(but that needs a disclaimer so see below)

Profit & Loss Account

Revenues fell 12% from $63.9m to $56.1m whilst costs fell

2% from $74.0m to $72.5m. Government grants

added around $5m income in both 2022 and 2021

Therefore, the Operating Loss rose from $9.5m in 2021 to

$16.3m in 2022. In other words, CCP has more

to do to reverse this trend and then turn a loss into a profit.

Finance Costs and Currency movements took off an

additional $4m in 2022 and $3m in 2021.

Add back some tax rebates and the bottom line for the underling business

was $19.2m vs $8.1m in 2021.

And then, the impairment charge of $51m kicks in which is

basically Pearl Abyss admitting it paid too much for CCP and can no longer justify

the value of the investment in part due to rising interest rates (rising rates

reduces todays value of future earnings) and in part due to CCP being unable to

meet the expectations set at the time of its sale to Pearl Abyss.

Revenues

Overall revenues fell 12% from $63.9m to $56.1m.

It is important to realise that if revenues in Eve Online

go up or down then it does not mean the costs of the business go up or down as

it would in other businesses. The costs of

this business are more about creating new content, marketing the game, running

the offices. So the costs have nothing

to do with how many players are paying and what they are paying.

So, in this case of a fall in revenues it goes straight to

the bottom line and increases the loss.

Now, this $56.1m is not the player base of Eve Online

paying subs and utilising Plex. It is a

combination of that and Royalties & Licences and a few other minor bits and

bobs, as the notes in the Accounts show below.

The largest line in revenues are players that pay money

to play the game including Plex that is used in the period and that fell 12%

from $53.8m to $47.3m. For reference, in

2020 this came to $55.8m. Recall that in

January 2021 the subs price was raised 30% and again in May 2022 the subs price

rose 30% whilst the effect over the two years has been for the player base

revenues to fall 15%.

Revenues fell in all regions: North America fell 8%;

Europe fell 18% (there will be a Russia effect in there); Asia fell 14% (actually,

all the Royalties & Licences are Asia with NetEase which means the player

base revenues in Asia fell 21%); and the rest of the world (which includes

Australia) fell 13%.

How to think about the subs price rises vs player base

numbers? I am not sure but it is clear

to me that the paying player base has clearly fallen quite a bit over the last

1 and 2 years.

The Royalties & Licences line also fell 12% from

$10.0m to $8.8m. This is paid by NetEase

who distribute the game in China (which is on a separate server). I am not looking too closely at this but the

fact it declined presumably indicates there is a decline in China or the terms

have been renegotiated.

Gross Profit

The cost of actually running the game (as opposed to

creating new code, marketing et al) is very low at around $5m for both 2022 and

2021. Nothing really to add here.

Operating Expenses

CCP now expense all their development costs (historical

costs are still being held on the Balance Sheet and reduced over time). This is a much cleaner way to account for these costs.

Ignore the Impairment Loss for now which means Operating

Expenses in 2022 were $72.5m vs $74.0m in 2021 – i.e. a decline of 2%. Which is impressive given the inflationary

background.

Research & Development is the core of the business,

this is the development of new content, expansions, the works and any new

games. This was basically flat at $37.9m

and salaries will be a noticeable part of it.

Hard to know how to read this. Presumably

wages went up a decent chunk and so therefore did the number of employees in

this area decline? Not sure.

Publishing stayed flat at $4m.

Marketing fell 12% from $14.2m to $12.5m.

General & Administrative (so everything that is not

coders, marketing and publishing – i.e. finance people, office services,

utilities etc) fell 2% from $18.1m to $17.8m in what must have been a high

inflationary environment, so that was good work by CCP though the quantum of the General & Administrative cost has always looked high to me. It is currently 32% of revenues which is off the dials compared to other businesses i look at.

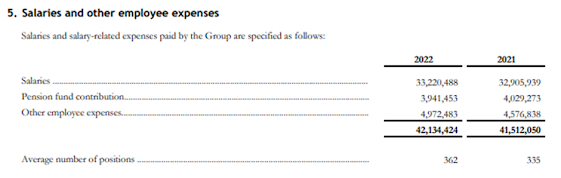

Of the $72.5m Operating Costs the largest item is Salaries

(this is a people business after all):

Overall, those rose 1% to $42m whilst the average number

of employees rose 8%. Clearly a mix

effect going on here – did the number of coders decline vs a rise elsewhere? Not sure.

Worth noting that Salaries as a % of EVE Online Revenues

rose to 89% vs 77% in 2021 and if we include the NetEase income then this % was

75% vs 65% in 2021. This is getting

tight. We are closing in on the day when revenues will struggle to cover employee costs let alone everything else.

Overall, given the inflationary background it seems to me

that costs were very well controlled.

The problem is not costs, it is revenues.

Other Income

There was $5m-$6m of Other Income in each year which is

Government Grants

Finance Costs

The Group has a $50m bank loan from The Korea Development

Bank which is due for repayment in 2024.

Clearly, inline with global trends, the interest rate charged has gone

up. Therefore, interest paid rose to $2.4m

from $1.9m. The business pays 5.53%

interest rate on that loan (that is reasonable and does not suggest the bank has any concerns - but there will be a guarantee from the parent company Pearl Abyss in Korea here).

Currency movements cost $1.6m in 2022 vs only $0.2m in

2021.

Tax

Given the business makes a loss, in Accounting the loss

is reduced by a tax rebate (in actual cash flows tax is still paid given this

is a global business making sales across the world – somewhere there will be

profits to tax). This accounting rebate

was $1.4m in 2022 vs $3.7m in 2021.

Underlying operating loss

Add all that up and the underlying operating loss of the

business rose from $8.1m to $19.2m. And it is because of the fall in revenues.

To put this in perspective, to move back to profits and assuming costs are flat in 2023, revenues need to rise by 34% to around $75m.

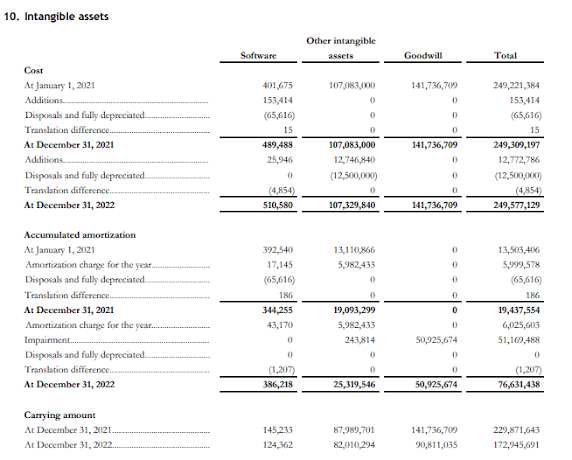

Impairment charge

I have been expecting this for a while and it is interesting

to note that where was no indication in the Pearl Abyss results in February

that this had happened.

In fact, in the Pearl Abyss results there is no indication that CCP is loss making let alone the losses have risen.

Anyway, to put this simply, when Pearl Abyss bought CCP they have

to allocate the payment between the assets of CCP they bought, a number of

intangible assets (the Intellectual Property, Customer relationships) and

anything left is called Goodwill. Every year,

the business must ask itself if they can still justify the value of this goodwill

by looking at the expected earnings of CCP and adding it all up and comparing

to the original purchase price.

There two things that can reduce the summation: firstly, rising rates makes the value of

future earnings lower in todays money (i.e. $100 next year is worth $91 today if

interest rates are 10% but that $100 is worth $95 today if interest rates are

5%); secondly, CCP may decide that the earnings they expected to make in future

years at the time of the sale to Pearl Abyss are now unrealistic and need to be

rebased.

Both appear to have happened.

Therefore, the Goodwill of $141m has been reduced by

$51m. It is non cash but does indicate

that the expected growth of the earnings of Eve Online is less than previously thought.

The Korean senior management will not be happy.

Balance Sheet

This is a bit more exciting in 2022 vs 2021.

CCP is loss making in aggregate since sale to Pearl Abyss

The standout feature is that the sum of all earnings made

by Pearl Abyss Iceland (i.e. all the earnings produced by CCP since acquisition)

is now negative. And that is before we

consider the $51m impairment.

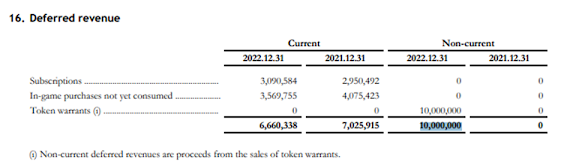

Plex

Plex, as we know, is sold to the player base for real

money and can be converted into ingame currency in the ingame market. To recognise this sale as revenues then CCP

needs to wait for the Plex to be used.

So, the way that Plex in inventory is accounted for is

that Cash comes in and the other side of the accounting entry sits in Deferred

Income. Once it is used, the Deferred Income

becomes Revenues.

It is called “In-game purchases not yet consumed”

In 2022 the amount of “In-game purchases not yet consumed”

(Plex) actually fell from $4.1m to $3.6m despite all the sales in September and

later.

That says a number of things to me: firstly, Plex in

inventory was used during this time to convert to Omega at cheap rates; secondly,

any plex bought for real money was used up quickly; thirdly, perhaps Plex sales

are falling. Personally, I think the

destocking was a bigger driver.

Also, note in the table above the Subscription Deferred revenue (so people that pay for 3, 6, 12, 24 months where part of that is still to run after December 2022) is only slightly up despite the 30% increase in subs. So, either the mix of longer term subs is down or less players are buying them overall.

Crypto Currencies

There is a non-current Deferred Revenue amount of $10m (see

the above table). This is not Plex.

In the Cashflow Statement there is an inflow of $12.5m which

is stated as “Proceeds from sale of intangible assets”.

I don’t know if these amounts are related but I suspect

they are (can make an argument in the other direction though). $12.5m cash comes in and $10m of it sits on

the Balance Sheet for now waiting to be moved into Revenues in the future.

In the table below, it sort of looks like the $12.5m disposal was an asset created out of thin air - which makes it more likely to be linked to the $10m above. But i really don't know.

There is loads more to say about this from the Accounts

but it seems the Group is developing a blockchain based network and planning to

issue crypto tokens once the development is complete. Ahead of this point in time the group has already

sold warrants which will allow holders to convert these into the tokens when

they are issued. I.e., the group is

getting some cash in now for future sales.

And to make this more intriguing / exciting, the group

goes on to say that it holds other crypto assets such as Ethereum for “various

business purposes” but not for resale. I

have no idea as to what their value is.

Cashflow statement

This is the sharp end of it all and the business did well

to avoid losing any cash!

At the end of the day, the underlying loss of $19m caused

cash to reduce by $9.4m – there are always non cash items in the Profit &

Loss account such as depreciation. In

any given year cash and profits are rarely the same for any business.

And then a further $4.3m was spent on capex (office

equipment, IT, intangible assets) and this was offset by the $12.5 discussed

above coming in.

And then, just when you think it is all lost a further $3m of new shares were issued and taking into account lease payments of $1.4m

the business did not lose any cash in the year!

That $12.5m inflow saved the day. No idea who was the other side of that transaction.

Unless they can keep on pulling these rabbits out of the hat eventually cash will start flowing out of the business. Hence the focus on getting those revenues back up.

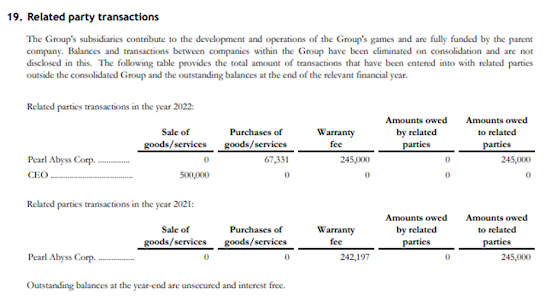

CEO Salary?

Thee are two items here which give a clue. I am not here to speculate on someone’s

remuneration so I will just put the items below with a few lines of text

So, the table above merely gives the total payments made

to the Directors and CEO. I am guessing

the Korean directors are not paid so this will be all the non-Korean directors

which is the CEO and perhaps one other.

I have no idea what the $500k “Sales of goods / Services”

is here. Also, i don't really know if that is the business selling $500k of items to the CEO or the other way round!

With the filing of PAI's financials, the Pearl Abyss earnings call will be interesting next week. Pearl Abyss revealed a ₩100.3 billion loss in the fourth quarter of 2022. But that was mostly due to the depreciation of assets at the end of the year belonging to Pearl Abyss Capital, not Pearl Abyss Iceland. At least, that's what was said on the call. At the time, KRW 100 billion was equal to around $79.5 million USD. I didn't see or hear about anything on the call stating that there was another $50 million in losses from Iceland.

ReplyDeleteBy the way, that loan from the Korean bank was taken out in 2018 or 2019 as a variable rate loan and it appears none of the principal has been paid down. In 2021, the rate was 1.57%. In 2022, the rate averaged 5.53%. That had to hurt.

I always enjoy reading your takes on CCP's finances. Keep up the good work!

thanks Noizy

DeleteThis was is a very interesting read now that the curtain to Project Awakening has been pulled back somewhat.

ReplyDelete